DRAM Market Overview:

The DRAM (Dynamic Random Access Memory) market is a crucial segment of the semiconductor industry, playing a fundamental role in storing and retrieving data in electronic devices such as computers, smartphones, servers, and automotive systems. DRAM chips provide volatile memory storage, enabling fast access to data for processing by the device’s central processing unit (CPU). This comprehensive overview delves deep into the historical developments, current trends, product portfolio, production mode & process, restraints, and data triangulation methods relevant to the DRAM market.

Historical Developments:

The development of DRAM technology can be traced back to the early days of computing when volatile memory solutions were required to store program instructions and data for processing. The first commercially available DRAM chip, the Intel 1103, was introduced in 1970, marking a significant milestone in the history of semiconductor memory. The Intel 1103 offered 1 kilobit (1Kb) of storage capacity and revolutionized the computer industry by providing a cost-effective alternative to existing memory technologies such as magnetic core memory.

Throughout the 1970s and 1980s, DRAM technology continued to advance rapidly, with manufacturers increasing chip densities, improving performance, and reducing production costs. The introduction of higher-density DRAM chips, such as 64Kb and 256Kb devices, enabled the development of more powerful and affordable computers, fueling the growth of the personal computing market.

In the 1990s, the proliferation of multimedia applications and the emergence of the internet drove demand for higher-performance DRAM solutions. Manufacturers responded by introducing faster DRAM architectures, such as synchronous DRAM (SDRAM) and double data rate (DDR) SDRAM, which offered increased bandwidth and improved data transfer rates.

The early 2000s saw the introduction of DDR2, DDR3, and DDR4 DRAM technologies, each offering successive improvements in performance, power efficiency, and data capacity. These advancements enabled the development of high-performance computing systems, gaming consoles, and mobile devices with increasingly demanding memory requirements.

In recent years, the DRAM market has faced challenges related to technological scaling, manufacturing complexity, and market consolidation. Despite these challenges, ongoing innovations in DRAM architecture, materials science, and process technology continue to drive advancements in memory performance, capacity, and reliability, ensuring the continued relevance and growth of the DRAM market in the digital age.

Trends:

Several key trends are shaping the evolution of the DRAM market and influencing product development, market dynamics, and consumer demand:

- Increasing Demand for Memory Intensive Applications: The proliferation of data-intensive applications such as artificial intelligence (AI), machine learning, big data analytics, and high-resolution multimedia content creation is driving demand for high-capacity and high-performance DRAM solutions. These applications require large memory capacities and fast data access speeds to process and analyze vast amounts of data efficiently.

- Rise of Cloud Computing and Data Centers: The growth of cloud computing services and data center infrastructure is fueling demand for server DRAM solutions optimized for performance, reliability, and power efficiency. Data center operators require DRAM modules with high memory bandwidth, low latency, and error correction capabilities to support virtualization, cloud storage, and real-time data processing workloads.

- Expansion of Mobile and IoT Devices: The proliferation of smartphones, tablets, wearable devices, and Internet of Things (IoT) sensors is driving demand for low-power, high-density DRAM solutions optimized for mobile and embedded applications. Mobile DRAM chips with reduced power consumption, compact form factors, and high-speed interfaces enable manufacturers to design slim, energy-efficient devices with enhanced multimedia capabilities and multitasking performance.

- Transition to Advanced Process Nodes: DRAM manufacturers are transitioning to advanced process nodes, such as sub-10nm FinFET technology, to increase chip densities, reduce power consumption, and improve manufacturing yields. Shrinking transistor dimensions enable higher integration levels and lower production costs, allowing manufacturers to offer higher-capacity DRAM products at competitive prices.

- Emergence of New Memory Architectures: The development of novel memory architectures, such as HBM (High Bandwidth Memory), GDDR (Graphics Double Data Rate) memory, and LPDDR (Low Power Double Data Rate) memory, is expanding the range of memory solutions available to consumers and enabling new applications in graphics processing, automotive electronics, and high-performance computing.

Product Portfolio:

The DRAM market encompasses a diverse range of products tailored to meet the varying performance, capacity, and power requirements of different applications and end-user segments. Key product categories include:

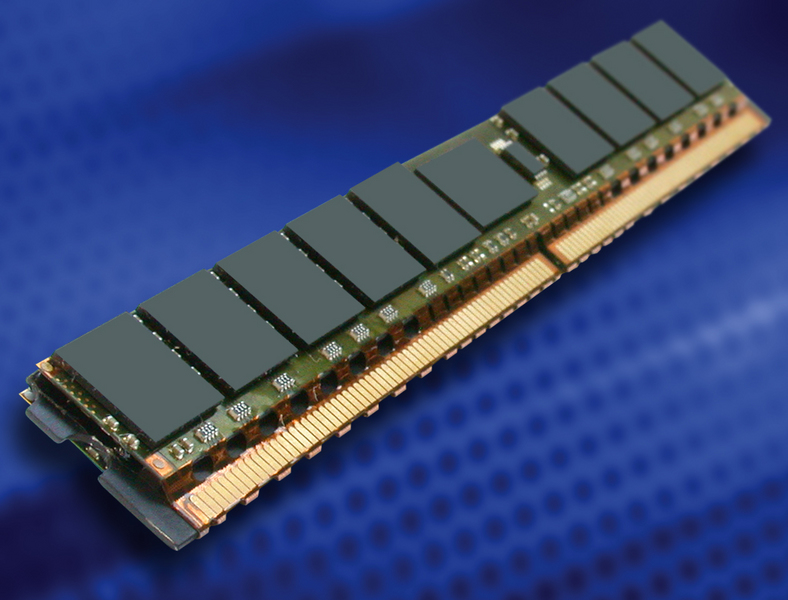

- Server DRAM: Server DRAM modules are optimized for use in data center servers, cloud computing platforms, and enterprise storage systems. These modules typically offer high capacities, fast data transfer rates, and advanced error correction capabilities to support mission-critical workloads, virtualization, and in-memory database applications.

- Desktop and Laptop DRAM: Desktop and laptop DRAM modules are designed for use in consumer PCs, workstations, and gaming rigs. These modules come in standard form factors such as DIMMs (Dual Inline Memory Modules) and SO-DIMMs (Small Outline Dual Inline Memory Modules) and offer a balance of performance, capacity, and affordability for mainstream computing tasks and multimedia applications.

- Mobile DRAM: Mobile DRAM chips are tailored for use in smartphones, tablets, wearables, and other mobile devices with stringent power and space constraints. These chips feature low-power architectures, compact package sizes, and high-speed interfaces to enable energy-efficient multitasking, seamless app performance, and multimedia-rich user experiences on mobile platforms.

- Graphics DRAM: Graphics DRAM solutions are optimized for use in graphics processing units (GPUs), gaming consoles, and high-performance computing applications. These solutions offer high memory bandwidth, low latency, and efficient data compression techniques to deliver smooth frame rates, immersive graphics rendering, and real-time visual effects in gaming and multimedia applications.

- Automotive DRAM: Automotive DRAM products are designed to meet the reliability, temperature, and quality requirements of automotive electronics systems, including infotainment systems, advanced driver assistance systems (ADAS), and autonomous driving platforms. These products offer robustness, longevity, and extended temperature ranges to ensure reliable operation in harsh automotive environments.

Receive the FREE Sample Report of DRAM Market Research Insights @ https://stringentdatalytics.com/sample-request/dram-market/10990/

Market Segmentations:

Global DRAM Market: By Company

• SK Hynix Inc.

• Micron Technology Inc.

• Samsung Electronics Co. Ltd.

• Nanya Technology Corporation

• Winbond Electronics Corporation

Global DRAM Market: By Type

• DDR3

• DDR4

• Others

Global DRAM Market: By Application

• Mobile Device

• Computers

• Server

• Others

Regional Analysis of Global DRAM Market

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global DRAM market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Click to Purchase DRAM Market Research Report @ https://stringentdatalytics.com/purchase/dram-market/10990/

Production Mode & Process:

The production of DRAM chips involves a series of complex processes, including semiconductor fabrication, lithography, etching, deposition, doping, and packaging. The production mode and process for DRAM chips typically include the following stages:

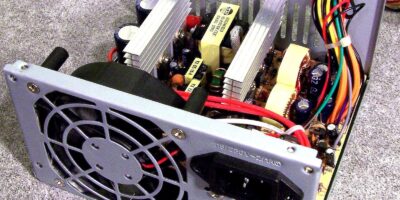

- Wafer Fabrication: The fabrication process begins with the production of silicon wafers using single-crystal silicon ingots grown through the Czochralski method. The wafers are then polished to a mirror-like finish and coated with layers of insulating materials, conductive materials, and semiconductor films using deposition techniques such as chemical vapor deposition (CVD) and physical vapor deposition (PVD).

- Photolithography: Photolithography is used to pattern the various layers of the DRAM chip by selectively exposing photoresist-coated wafers to ultraviolet (UV) light through a photomask. The exposed regions of the photoresist are then chemically etched away, leaving behind the desired patterns for the transistor gates, interconnects, and memory cells.

- Etching and Doping: Etching processes are used to remove excess materials and shape the transistor structures and interconnects on the wafer. Doping techniques such as ion implantation are used to introduce impurities into the semiconductor material to modify its electrical properties and create the source, drain, and channel regions of the transistors.

- Annealing and Activation: Annealing processes are used to heat treat the wafers and activate the dopants, allowing them to diffuse into the semiconductor material and form well-defined transistor junctions. Rapid thermal annealing (RTA) and laser annealing techniques are used to precisely control the dopant activation process and optimize the electrical performance of the DRAM cells.

- Die Cutting and Packaging: Once the fabrication process is complete, the wafers are diced into individual DRAM chips using diamond saws or laser cutting tools. The chips are then assembled into packages and encapsulated in protective materials to form finished DRAM modules. Packaging techniques such as wire bonding and flip-chip bonding are used to connect the chips to the package substrate and create electrical connections between the chip and the external interface pins.

- Testing and Quality Control: Finished DRAM modules undergo rigorous testing and quality control procedures to ensure that they meet the specified performance, reliability, and compatibility requirements. Functional tests, parametric tests, and burn-in tests are conducted to verify the functionality of the DRAM chips and identify any defects or manufacturing flaws that may affect product performance or reliability.

Restraints:

Despite the promising growth prospects for the DRAM market, several factors may pose challenges and constraints to market expansion. These restraints may include:

- Cyclical Demand and Supply Dynamics: The DRAM market is characterized by cyclical demand and supply dynamics driven by factors such as technological innovation, macroeconomic conditions, and industry consolidation. Periods of oversupply can lead to price erosion and margin pressure for DRAM manufacturers, while periods of undersupply can result in supply chain disruptions and allocation issues for end-users.

- Technological Complexity and Scaling Challenges: The continued scaling of DRAM technology to smaller process nodes faces technical challenges related to transistor scaling, power consumption, and manufacturing yields. Shrinking transistor dimensions increase device sensitivity to process variations, defects, and reliability issues, requiring advanced materials, process technologies, and design techniques to overcome these challenges and maintain product quality and performance.

- Market Consolidation and Competition: The DRAM market is highly concentrated, with a few dominant players controlling a significant portion of global market share. Market consolidation through mergers, acquisitions, and strategic alliances can limit competition and innovation, leading to reduced product diversity, higher barriers to entry, and potential antitrust concerns in the semiconductor industry.

- Regulatory and Trade Restrictions: Regulatory measures and trade restrictions imposed by governments and international organizations can impact DRAM manufacturers’ ability to access key technologies, materials, and markets. Tariffs, export controls, and intellectual property disputes can disrupt global supply chains, increase production costs, and hinder market growth, particularly in regions with significant geopolitical tensions or trade disputes.

- Intellectual Property and Patent Litigation: Intellectual property (IP) disputes and patent litigation are common in the semiconductor industry, with companies frequently filing lawsuits to protect their proprietary technologies and enforce their patent rights. Legal battles over patent infringement, licensing agreements, and trade secrets can result in costly legal fees, product recalls, and reputational damage for DRAM manufacturers, affecting their financial performance and market competitiveness.

Data Triangulation:

Market analysis in the DRAM market relies on data triangulation, a methodological approach that combines multiple data sources and analytical techniques to validate findings and ensure the accuracy and reliability of market insights. Data triangulation involves cross-referencing information from diverse sources, including:

- Primary Research: Conducting interviews, surveys, and focus groups with key stakeholders in the semiconductor industry, including DRAM manufacturers, technology suppliers, equipment vendors, industry associations, and market analysts. Primary research provides firsthand insights into market trends, supply chain dynamics, technology developments, and competitive strategies shaping the DRAM market.

- Secondary Research: Reviewing existing literature, market reports, industry publications, regulatory documents, patent filings, and financial filings to gather historical data, market intelligence, competitive analysis, and industry benchmarks relevant to the DRAM market. Secondary research helps validate primary research findings and identify additional sources of information for analysis.

- Quantitative Analysis: Utilizing statistical methods, data modeling, and forecasting techniques to analyze numerical data such as market size, revenue projections, unit shipments, pricing trends, market share, and key performance indicators (KPIs) across different market segments, geographic regions, and end-user industries. Quantitative analysis provides empirical evidence to support market trends and predictions and identify patterns and correlations in the data.

- Qualitative Analysis: Applying qualitative research methods, such as content analysis, thematic coding, and narrative synthesis, to interpret textual data, extract meaningful insights, identify emerging trends, and understand the underlying drivers and implications shaping the DRAM market. Qualitative analysis complements quantitative analysis by providing context, depth, and richness to the data and facilitating a deeper understanding of market dynamics and stakeholder perspectives.

By triangulating data from multiple sources and employing a combination of qualitative and quantitative research methodologies, analysts can enhance the robustness and credibility of their market analysis, minimize bias and uncertainty, and provide stakeholders with actionable insights and strategic recommendations for informed decision-making in the DRAM market.

About Stringent Datalytics

Stringent Datalytics offers both custom and syndicated market research reports. Custom market research reports are tailored to a specific client’s needs and requirements. These reports provide unique insights into a particular industry or market segment and can help businesses make informed decisions about their strategies and operations.

Syndicated market research reports, on the other hand, are pre-existing reports that are available for purchase by multiple clients. These reports are often produced on a regular basis, such as annually or quarterly, and cover a broad range of industries and market segments. Syndicated reports provide clients with insights into industry trends, market sizes, and competitive landscapes. By offering both custom and syndicated reports, Stringent Datalytics can provide clients with a range of market research solutions that can be customized to their specific needs.

Reach US

Stringent Datalytics

+1 346 666 6655

Social Channels:

Linkedin | Facebook | Twitter | YouTube

Leave a Reply