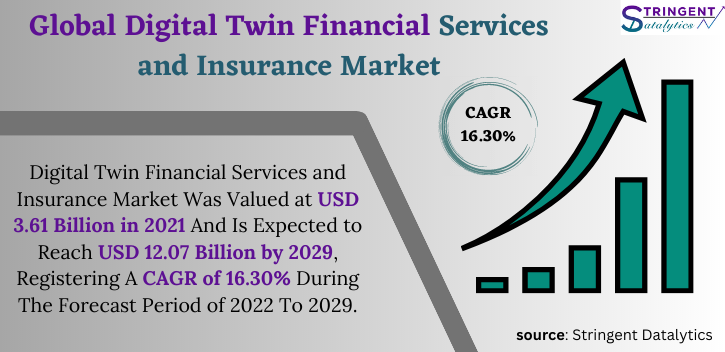

Digital Twin Financial Services and Insurance Market

Digital Twin Financial Services and Insurance Market Was Valued at USD 3.61 Billion in 2021 And Is Expected to Reach USD 12.07 Billion by 2029, Registering A CAGR of 16.30% During The Forecast Period of 2022 To 2029.

The global digital twin market within the financial services and insurance sector has experienced substantial growth and innovation in recent years. This executive summary provides an overview of the market, highlighting key trends, drivers, challenges, and opportunities shaping its landscape.

Digital twin technology involves creating a virtual replica or digital representation of physical assets, processes, or systems. In the financial services and insurance sector, digital twin applications are used to simulate and analyze various scenarios, optimize operations, enhance risk management, and improve customer experiences.

The market for digital twin solutions in financial services and insurance has witnessed significant growth due to the increasing adoption of advanced technologies, such as Internet of Things (IoT), big data analytics, artificial intelligence (AI), and cloud computing. These technologies enable the collection and analysis of vast amounts of data, allowing organizations to gain real-time insights, improve decision-making, and enhance operational efficiency.

Download a Free PDF Brochure: https://stringentdatalytics.com/sample-request/digital-twin-financial-services-and-insurance-market/69/

Market Segmentations:

By Company

• IBM Corporation

• Atos SE

• Swim

• General Electric

• Microsoft Corporation

• SAP SE

• ABB Group

• Kellton Tech

• AVEVA Group

• PTC

• ANSYS

• DXC Technology Company

• Bosch.IO GmbH

• Siemens AG

• Oracle Corporation

By Type

• Cloud

• On Premises

By Application

• Bank Account Funds Check

• Digital Funds Transfer Check

• Policy Creation

• Other Applications

Regional Analysis

All the regional segmentation has been studied based on recent and future trends, and the market is forecasted throughout the prediction period. The countries covered in the regional analysis of the Global Digital Twin Financial Services and Insurance market report are U.S., Canada, and Mexico in North America, Germany, France, U.K., Russia, Italy, Spain, Turkey, Netherlands, Switzerland, Belgium, and Rest of Europe in Europe, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, China, Japan, India, South Korea, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), and Argentina, Brazil, and Rest of South America as part of South America.

Buy Now Digital Twin Financial Services and Insurance Market Research Report: https://stringentdatalytics.com/purchase/digital-twin-financial-services-and-insurance-market/69/?license=single

Key Drivers:

Key Challenges:

Key Opportunities:

Contact US:

Stringent Datalytics

Contact No – +1 346 666 6655

Email Id – sales@stringentdatalytics.com

Follow US:

https://www.linkedin.com/company/stringent-datalytics/

https://twitter.com/StringentDataL

https://www.facebook.com/stringentdatalytics/

[Pune, 12-03-2025] – The global Retail Pack Whole Fresh White Mushroom Market is witnessing significant…

[Pune, 11-03-2025] – The global flax milk market is experiencing rapid expansion, with market valuation…

The global Food and Beverages Market is set for remarkable growth, projected to reach $11,149.19…

[Pune, 07-03-2025] – The airline booking system market continues to be a crucial component of…

[Pune,07-03-2025] – The Affiliate Program Software market continues to evolve as businesses worldwide recognize the…

March 2025 – [Your Location] – The global Matcha Products Market is projected to grow…